In Gold We Trust: Checking the Latest Rate Trends

For investors who believe in the enduring value of gold, staying updated on the latest rate trends is essential. Gold has long been regarded as a safe haven asset, providing a hedge against economic uncertainties. To effectively monitor and analyze Gold Rates in Hyderabad trends, investors need reliable resources and tools that provide accurate and timely information. In this article, we will explore various ways to check the latest rate trends and make informed decisions.

Real-Time Market Data

Access to real-time market data is crucial for checking the latest rate trends. Numerous financial platforms and websites provide up-to-date information on Gold Rates in Mumbai sourced from international markets. These platforms offer real-time spot Gold Rates in Hyderabad, historical charts, and other relevant data points. By leveraging these resources, investors can track the latest rate trends and gain insights into the dynamics of the gold market.

Technical Analysis Tools

Technical analysis tools are valuable resources for investors looking to analyze rate trends. These tools help identify patterns, trends, and potential support or resistance levels in the gold market. Investors can utilize various technical indicators, such as moving averages, trendiness, and oscillators, to gain insights into the direction of Gold Rates in Hyderabad. By employing technical analysis, investors can make more informed decisions and develop effective trading strategies.

Market News and Analysis

Keeping abreast of market news and analysis is essential for understanding the factors that influence Gold Rates in Hyderabad trends. Reputable financial news sources provide insights into global economic trends, geopolitical events, and monetary policies that impact the Gold Rates in Mumbai. By staying informed about these factors, investors can gain a deeper understanding of the broader economic landscape and make informed decisions based on the latest market trends.

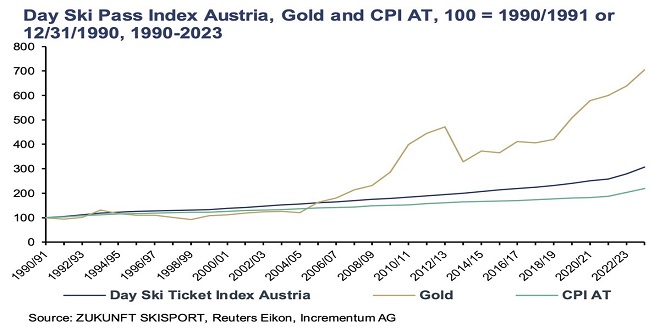

Historical Data and Performance Charts

Analyzing historical data and performance charts is a valuable tool for checking rate trends. By studying Gold Rates in Hyderabad movements over different timeframes, investors can identify patterns and trends. Historical data and performance charts provide a visual representation of rate movements, allowing investors to identify potential opportunities and make informed decisions. These tools help investors understand the volatility and historical performance of gold, providing valuable insights into rate trends.

Consulting with Experts and Financial Advisors

Seeking advice from experts or consulting with a financial advisor can provide valuable insights into rate trends. Experts and financial advisors have in-depth knowledge and experience in the gold market. They can offer personalized guidance based on individual investment goals and risk tolerance. By consulting with experts or financial advisors, investors can gain a deeper understanding of rate trends and develop strategies that align with their investment objectives.

Community Forums and User Discussions

Engaging in community forums and user discussions provides an opportunity to gain insights from other investors. These platforms allow investors to share perspectives, exchange ideas, and discuss rate trends. By participating in these discussions, investors can gain diverse perspectives and learn from the experiences of others. Community forums and user discussions provide an additional layer of information and can help investors make more informed decisions by checking gold rates in Hyderabad.

Conclusion

Checking the latest rate trends is essential for investors who have faith in the enduring value of gold or gold rates in Mumbai. By leveraging real-time market data, technical analysis tools, market news and analysis, historical data and performance charts, consulting with experts or financial advisors, and engaging in community forums and user discussions, investors can stay updated and make informed decisions.